When will the Philippines Catch up with the GDP PPP of Bangladesh?

A comprehensive economic analysis based on World Bank Data (1990-2024)

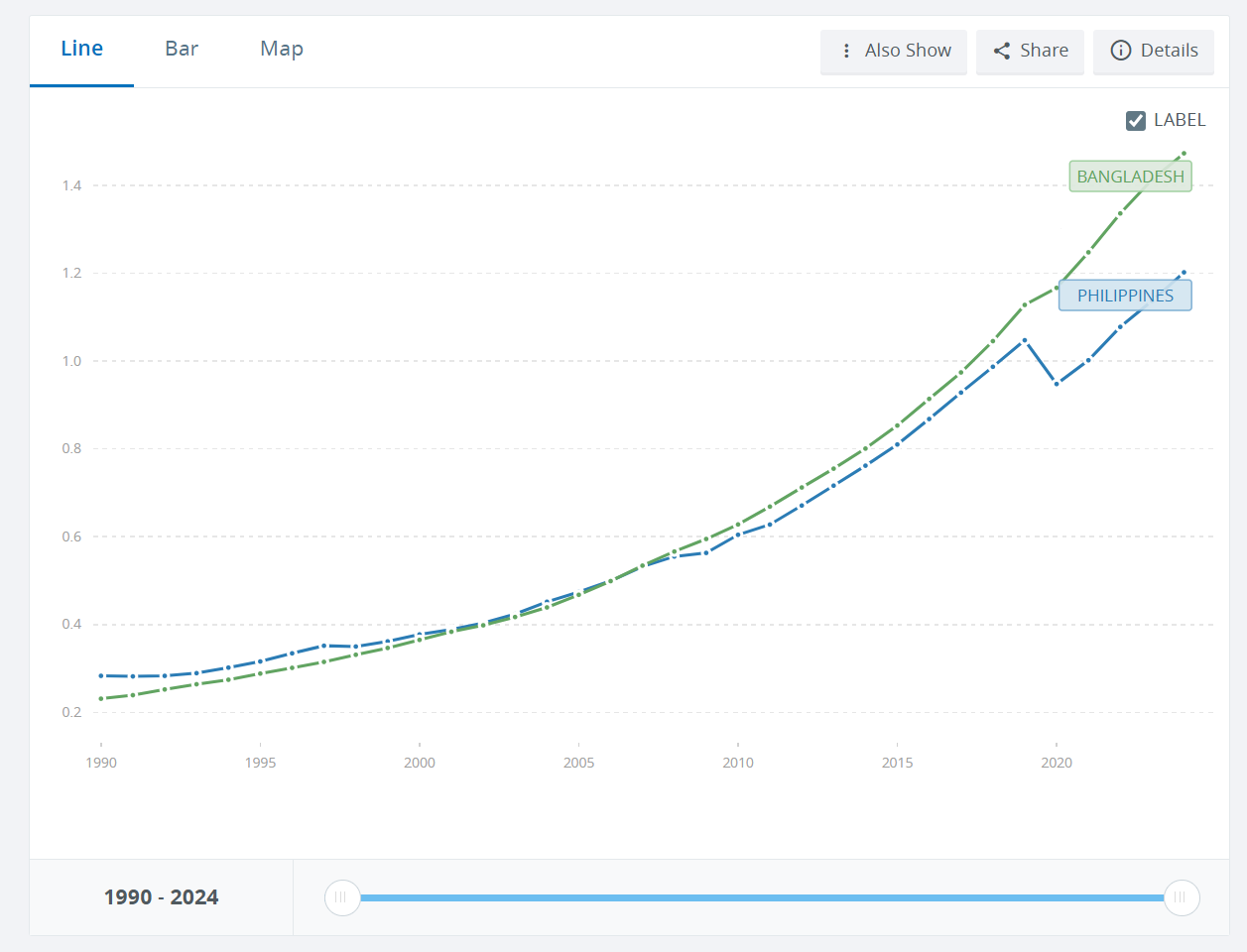

In this post, I analyze the economic trajectories of the Philippines and Bangladesh using Gross Domestic Product adjusted for Purchasing Power Parity (GDP PPP), measured in constant 2021 international dollars. The analysis reveals a remarkable economic story: Bangladesh, which trailed the Philippines by 22% in 1990, overtook it in 2018 and now leads by 23% as of 2024.

The central question this report addresses is whether, and when, the Philippines might regain its position. My analysis indicates that under current growth trajectories, such a reversal would require either a sustained acceleration in Philippine growth rates or a significant deceleration in Bangladesh’s economic expansion.

Understanding GDP PPP

GDP PPP is an economic metric that measures the total economic output of a country while accounting for differences in price levels across nations. Unlike nominal GDP, which simply converts local currency values to a common currency (typically US dollars) using market exchange rates, GDP PPP uses a theoretical exchange rate that would equalize the price of an identical basket of goods and services across countries.

The concept is built on the idea that in the long run, exchange rates should move toward levels that would equalize the prices of an identical basket of goods and services in any two countries. This “purchasing power” adjustment provides a more accurate comparison of living standards and real economic output between nations.

There are several reasons why economists and analysts prefer GDP PPP for cross-country comparisons.

First, it eliminates exchange rate distortions. Market exchange rates can be highly volatile and influenced by factors unrelated to the actual productive capacity of an economy, such as speculative capital flows, interest rate differentials, and political events. GDP PPP removes these distortions by using price-level-adjusted conversion rates.

Second, it is a better quantitative reflection of the true economic size. In developing countries, many goods and services (particularly non-tradables like housing, healthcare, and domestic services) are significantly cheaper than in developed nations. Nominal GDP understates the true economic activity in these countries because it doesn’t account for the fact that a dollar buys more in Manila or Dhaka than in New York.

Third, it is a more accurate living standard comparisons. Since GDP PPP accounts for what money can actually buy in each country, it provides a more meaningful comparison of material living standards and economic welfare across nations.

And fourth, its stability over time. By using constant 2021 international dollars, the dataset removes both inflation effects and exchange rate fluctuations, allowing for meaningful comparisons across decades.

Historical Analysis (1990-2024)

Starting Positions in 1990

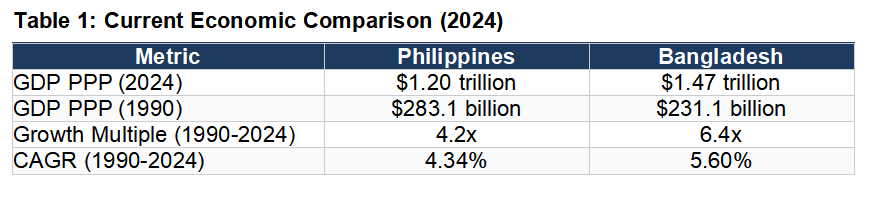

In 1990, the Philippines held a clear economic advantage over Bangladesh. The Philippine GDP PPP stood at about $283.1 billion, while Bangladesh’s was at about $231.1 billion. This meant the Philippines was approximately 23% larger than Bangladesh in terms of purchasing-power-adjusted economic output.

This gap reflected the Philippines’ earlier industrialization, stronger institutional foundations, higher urbanization rates, and more developed service sector. Bangladesh, having gained independence only in 1971 after a devastating war, was still in the early stages of economic reconstruction and development.

The Great Convergence (1990-2018)

Over the following 28 years, Bangladesh embarked on one of the most remarkable economic growth stories in modern history. While both economies grew substantially, Bangladesh consistently outpaced the Philippines, gradually closing the gap year after year.

Key factors driving Bangladesh’s superior growth included the explosive expansion of its ready-made garment (RMG) industry, which transformed it into the world’s second-largest apparel exporter; substantial inflows of remittances from workers abroad; improvements in agricultural productivity; successful poverty reduction programs; and investments in women’s education and workforce participation.

The Philippines, while growing respectably, faced challenges including, infrastructure bottlenecks, persistent poverty in rural areas, and heavy reliance on remittances without corresponding domestic industrial development.

The Crossover (2018)

In 2018, Bangladesh’s GDP PPP surpassed that of the Philippines for the first time in recorded history. This was a watershed moment, marking the culmination of nearly three decades of consistently higher growth. By this point, Bangladesh had grown its economy by approximately 4.6 times from its 1990 level, while the Philippines had grown by about 3.5 times.

COVID-19 Impact and Divergence (2018)

The COVID-19 pandemic dramatically accelerated Bangladesh’s lead. In 2020, the Philippines experienced a severe economic contraction of 9.5%, one of the worst in Southeast Asia, driven by strict lockdowns, collapse in tourism, and disruption to the services sector that dominates its economy.

Bangladesh, remarkably, managed to achieve positive growth of 3.2% in the same year. Its garment exports proved resilient as global demand for apparel continued, remittances remained strong, and the agricultural sector provided stability. None of these structural features Bangladesh successfully built over the years are present in the Philippines. This single year added approximately $175 billion to the gap between the two economies.

Current Economic Status (2024)

As of 2024, Bangladesh’s GDP PPP stands at $1.47 trillion, while the Philippines registers $1.20 trillion. Bangladesh now leads by $271 billion, representing a 22.5% advantage over the Philippines.

Growth Rate Analysis (2024)

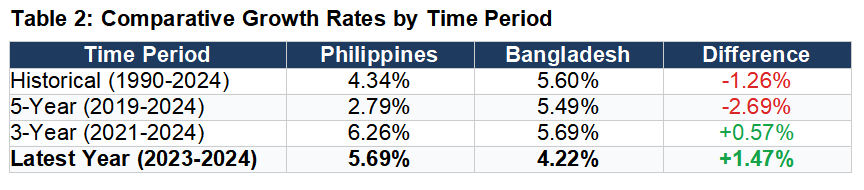

Understanding when the Philippines might catch up requires careful analysis of growth rates across different time horizons. Historical averages, recent trends, and the most current data tell different stories about each country’s economic momentum.

The data reveals a crucial insight: while Bangladesh has maintained a substantial growth advantage over the long term (1.21 percentage points higher CAGR over 34 years), the most recent data shows a reversal. In the latest year (2023-2024), the Philippines grew at 5.69% compared to Bangladesh’s 4.22%, giving the Philippines a 1.47 percentage point advantage.

This recent shift reflects several factors: the Philippines’ strong post-COVID recovery driven by pent-up consumer demand and services sector rebound; Bangladesh’s economic challenges including high inflation, foreign exchange pressures, and political uncertainties; and the maturation of Bangladesh’s export-dependent growth model.

Projection Scenarios: When Will the Philippines Catch Up?

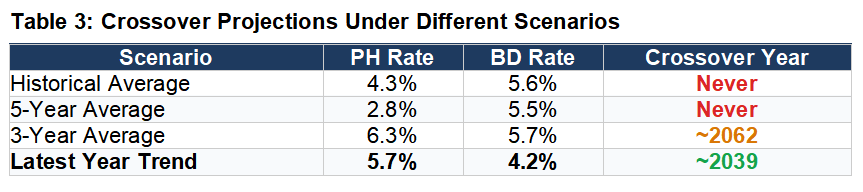

The answer to when the Philippines will catch up depends critically on which growth trajectory materializes going forward. I analyze four scenarios based on different assumptions about future growth rates.

Scenario 1 - Historical Average: If both countries continue at their 34-year average growth rates, the Philippines will never catch up. Bangladesh’s persistent 1.21 percentage point advantage would cause the gap to widen indefinitely.

Scenario 2 - Five-Year Average: This period is heavily influenced by COVID-19 and shows the Philippines at a significant disadvantage due to its severe 2020 contraction. Under this scenario, catch-up is impossible.

Scenario 3 - Three-Year Average: Post-pandemic recovery shows the Philippines gaining ground. If both countries maintain their 2021-2024 average growth rates, the Philippines could potentially catch up around 2062, approximately 38 years from now.

Scenario 4 - Latest Year Trend: The most optimistic scenario for the Philippines. If the 2024 growth differential persists, the Philippines could overtake Bangladesh by approximately 2039, roughly 15 years from now.

What Would It Take for the Philippines to Catch Up?

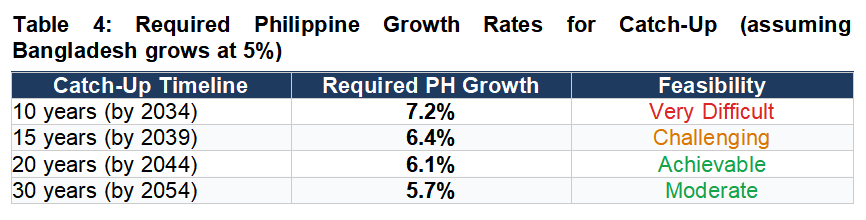

To provide practical guidance for policymakers and analysts, I calculate the sustained growth rates the Philippines would need to achieve to catch up to Bangladesh within various timeframes, assuming Bangladesh maintains a 5% annual growth rate.

The table illustrates the mathematical reality of catch-up growth. To close a 22.5% gap within 10 years while Bangladesh continues growing at 5%, the Philippines would need to sustain growth rates exceeding 7%—a level it has rarely achieved. More realistic timelines of 20-30 years require sustained growth in the 5.5-6.5% range, which is achievable but would require significant structural reforms and favorable external conditions.

The Most Likely Answer: Based on the most recent data, if the Philippines can sustain its 2024 growth advantage over Bangladesh, it could potentially overtake Bangladesh’s GDP PPP around 2039, approximately 15 years from now.

The Realistic Range: The catch-up timeline ranges from approximately 18 years (optimistic, based on 2024 trends) to never (if historical patterns reassert themselves). The most realistic estimate, using the 3-year average that smooths out COVID effects, suggests a crossover around 2059.

For the Philippines to reclaim its position, it would need to either achieve a sustained structural acceleration in its growth rate or benefit from a significant slowdown in Bangladesh. The most recent data offers some hope for the former, but whether the 2024 growth differential represents a new trend or a temporary fluctuation remains to be seen.

If you find value in what this blog does, please consider tipping via GCash - 09288956324 Buy me a Coffee to keep this blog sustainable and independent: https://www.buymeacoffee.com/srsasot

It’s hard to catch up if we Filipinos never learn voting a politicians that only have their own interest and pockets.

It feels like we can never catch up with Bangladesh under this current administration (and if the same governance continue even after 2028)